Managing payments, accounts, and cash flow can be challenging for any business. That’s where Plooto comes in—a smart, all-in-one payment automation platform designed specifically for growing businesses and accounting firms. Whether you’re looking to automate accounts payable and receivable or improve overall cash management, Plooto delivers powerful tools to simplify your workflow.

Key Features of Plooto

1. Payment Automation

Plooto automates both domestic and international payments, including ACH/EFT, credit card transactions, online checks, and even CRA payments in Canada. With Plooto, businesses can eliminate manual processing and reduce human errors.

2. Custom Approval Workflows

Set up customized, multi-level approval workflows for your team using Plooto. This ensures every payment goes through proper verification, providing enhanced security and compliance.

3. Seamless Accounting Integrations

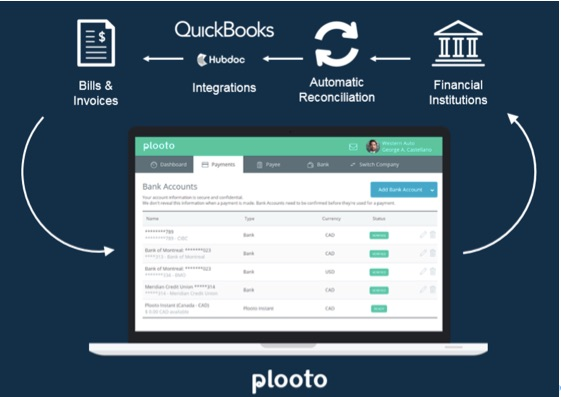

Plooto integrates with leading accounting software like QuickBooks, Xero, and NetSuite. Real-time syncing makes reconciling transactions easier and faster.

4. Invoice Capture and OCR

With Plooto‘s advanced invoice capture powered by OCR, manual data entry is a thing of the past. It automatically reads and processes invoice details, saving you valuable time.

5. Multi-User Support

Plooto allows unlimited users and roles, making it ideal for businesses with multiple stakeholders or accounting firms handling many clients.

6. Real-Time Insights

Stay on top of your cash flow with Plooto‘s real-time reporting tools. Get visibility into pending transactions, completed payments, and financial health all in one dashboard.

Benefits of Using Plooto

- Saves Time: Automating payments with Plooto can save businesses over 40 hours per month.

- Improves Accuracy: Reduces manual errors through automation and smart workflows.

- Enhances Security: Multi-tier approvals and encrypted data protection offer peace of mind.

- Supports Growth: Scales with your business as your financial operations become more complex.

Who Should Use Plooto?

Plooto is perfect for:

- Small to mid-sized businesses aiming to automate financial operations

- Accounting firms managing multiple clients

- Teams looking for better visibility into their payments and receivables

Final Thoughts

In today’s fast-paced business environment, automating your financial workflows is no longer optional—it’s essential. With Plooto, businesses get a secure, scalable, and cost-effective solution that simplifies payments and improves efficiency.

If you’re ready to take control of your business finances, try Plooto today and experience the benefits of streamlined financial operations.